You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The New Contract And Future Pension Contributions: Are We Ok. Or Are We Robbing Peter To Pay Paul?

- Thread starter Wally

- Start date

Over70irregs

Bans = Control…. Moving on

So the greatest difference between pensions is using PT as subsidy ?

542thruNthru

Well-Known Member

I'm sure that it's a factor. I don't know if it's the greatest difference. I still don't understand why other pensions wouldn't want or didn't include PTers. Aren't we all teamsters? What was the thinking there?So the greatest difference between pensions is using PT as subsidy ?

Over70irregs

Bans = Control…. Moving on

I never questioned it but east mid south union plans need to be called out. Peer 80 they call it needs to be the norm. Maybe gradually peer 85 84 83 82 81….. you catch my drift.I'm sure that it's a factor. I don't know if it's the greatest difference. I still don't understand why other pensions wouldn't want or didn't include PTers. Aren't we all teamsters? What was the thinking there?

542thruNthru

Well-Known Member

It's harder than it sounds. The pensions have gotten 2 big things that have improved them lately. Getting to the point of offering PEERs is probably going to take a lot more. I believe UPS is the only PEER 80 though I'm probably wrong. I know a lot of them are PEER 84 like the PTers are at UPS and my BA is at the local.I never questioned it but east mid south union plans need to be called out. Peer 80 they call it needs to be the norm. Maybe gradually peer 85 84 83 82 81….. you catch my drift.

Bubblehead

My Senior Picture

It is huge because it greatly helps to maintain the ratio of active participants to retirees.So the greatest difference between pensions is using PT as subsidy ?

Central States got upside down when the union freight industry, its largest participant, collapsed in the wake of deregulation and then NAFTA to a smaller degree.

I get yelled at when I say it, but pension funds are similar to ponzi schemes in the respect that they require someone to take the spot of the individual leaving to remain solvent as a result of what's termed "ongoing liability".

....or maybe I'm just a dumb truck driver that doesn't understand economics and actuarial calculations.

Last edited:

542thruNthru

Well-Known Member

You're a truck drive?....or maybe I'm just a dumb truck driver that doesn't understand economics and actuarial cacalculations.

Can you still claim that title after a few wins?

Over70irregs

Bans = Control…. Moving on

I’m sure your on it. Pensions are like a tapeworm, they require a sacrifice to keep going. But it’s hard to get medical and retirement working PT these days.It is huge because it greatly helps to maintain the ratio of active participants to retirees.

Central States got upside down when the union freight industry, its largest participant, collapsed in the wake of deregulation and then NAFTA to a smaller degree.

I get yelled at when I say it, but pension funds are similar to ponzi schemes in the respect that they require someone to take the spot of the individual leaving to remain solvent as a result of what's termed "ongoing liability".

....or maybe I'm just a dumb truck driver that doesn't understand economics and actuarial calculations.

What'dyabringmetoday???

Well-Known Member

J

And having foxes oversee the henhouse...It is huge because it greatly helps to maintain the ratio of active participants to retirees.

Central States got upside down when the union freight industry, its largest participant, collapsed in the wake of deregulation and then NAFTA to a smaller degree.

I get yelled at when I say it, but pension funds are similar to ponzi schemes in the respect that they require someone to take the spot of the individual leaving to remain solvent as a result of what's termed "ongoing liability".

....or maybe I'm just a dumb truck driver that doesn't understand economics and actuarial calculations.

Wally

BrownCafe Innovator & King of Puns

Over70irregs

Bans = Control…. Moving on

That’s our supreme leader. Clarify…

Wally

BrownCafe Innovator & King of Puns

Look at the crown, he's the pension czar.That’s our supreme leader. Clarify…

Over70irregs

Bans = Control…. Moving on

Triple vested.Look at the crown, he's the pension czar.

tourists24

Well-Known Member

Pony up west

Over70irregs

Bans = Control…. Moving on

Alt plan?

Over70irregs

Bans = Control…. Moving on

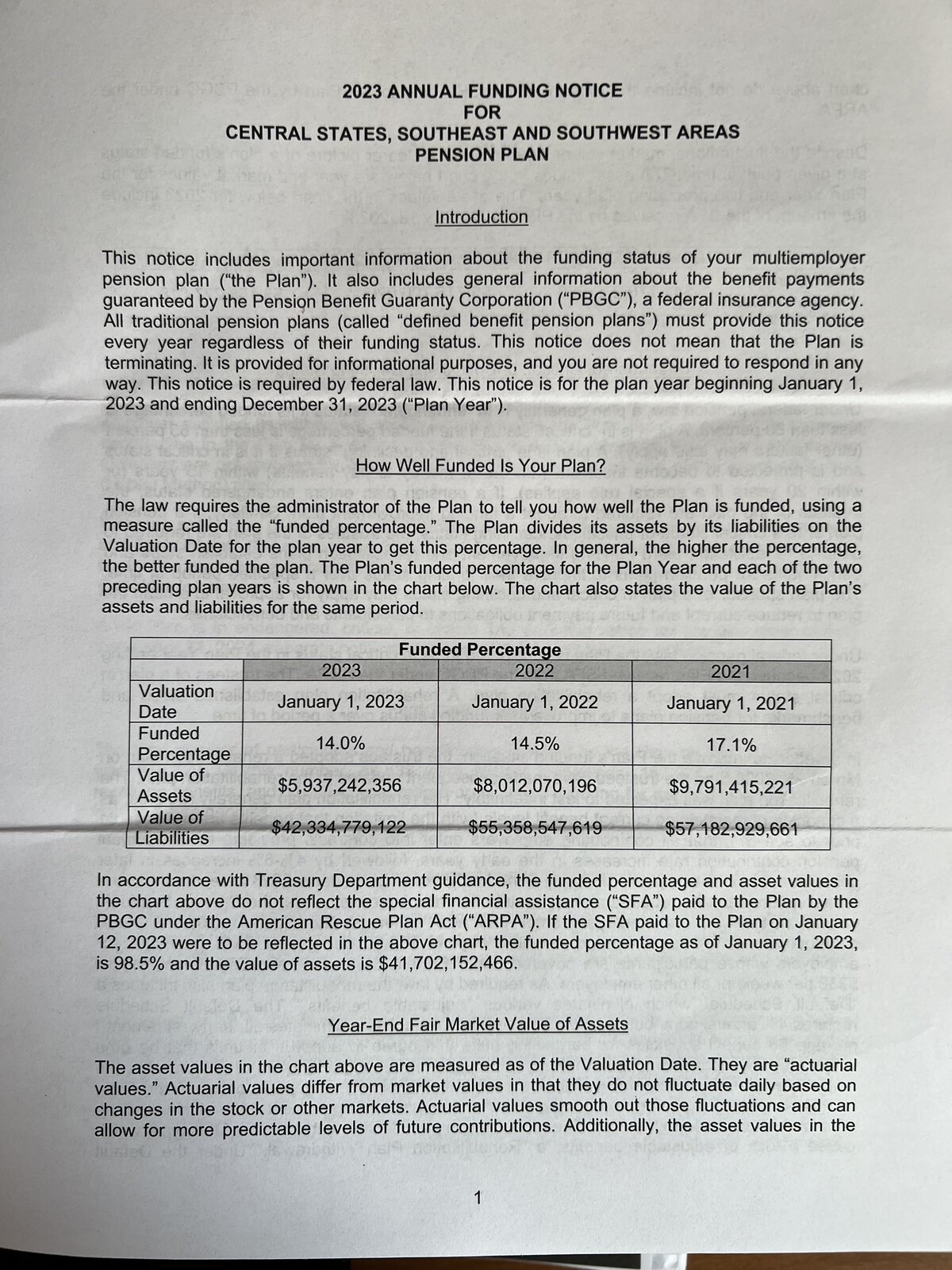

I am assuming that is a false sheet…. Please let it be fake.

oldngray

nowhere special

True. I got one of those a couple of days ago.I am assuming that is a false sheet…. Please let it be fake.

tourists24

Well-Known Member

The sheet is not a fake... I edited nothing. There was however another letter attached to the mailer stating the funding did get special funding assistance to help it outI am assuming that is a false sheet…. Please let it be fake.

Similar threads

- Replies

- 3

- Views

- 4K

- Replies

- 11

- Views

- 4K

- Poll

- Replies

- 73

- Views

- 11K

- Replies

- 78

- Views

- 14K